Chart courtesy of

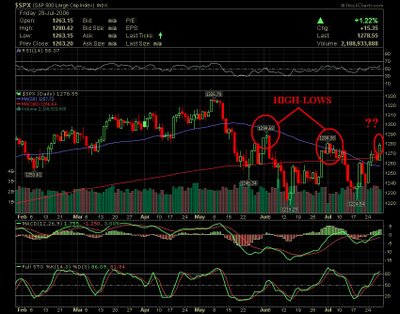

stockchartsThe Dowjones gained 119 points to 11.219. For the week, the Dowjumped 3.23% and the S&P500 gained 3.08%. Both Charts are in identical Bullish situations, however we can see 2 notes about the High-lows marks made in the last 2 months, that could make some sense if the market next week invert the Bullish situation.

Chart courtesy of

stockchartsBIDU stock, the Beijing-based company on Thursday said quarterly profit nearly quintupled and forecast third-quarter sales would almost triple, but its stock fell sharply as China's Web search leader succumbed to lofty expectations.The company posted a second-quarter profit of $7.3 million (58.5 million yuan), or 21 cents per diluted share, the revenue jumped 175 percent to 191.6 million yuan.

According to the chart above the oscillators still are moving to the downside and I believe, will continue to move down to test, in the short term, the $65 support for close the GAP.

Chart courtesy of stockcharts

Chart courtesy of stockcharts

Shares of Symantec Corp. the antivirus software maker rose on Thursday after the company posted a better-than-expected quarterly profit, helped by greater revenue from last year's acquisition of Veritas Software. In the daily time frame the chart shows that the RSI reached now the Overbought area, and shares are near the resistance area of $17.90, so we can have soon a possibility of a Pull-back.

Shares of Navteq "NVT" tumbled 23.73% or $8.22 in Thursday trading, after the company reported results below Wall Street estimates. On Wednesday after the markets closed the company said that the second-quarter profit dipped and blamed "unfavourable" trends and delays in product launches. The company earned $23.8 million, or 25 cents per share, compared with $25.3 million, or 27 cents per share, last year. Revenue rose 11 percent to $135.9 million from $122.8 million. For the second half of the year the president and chief executive Judson Green said that the company will continue to invest in its database and expects better performance. In the daily time frame the chart shows some rebound in the Fullstoch after the big drop, it's normal. Now the $30 will be the key resistance level.

That'a All. Have a great weekend and a great business week !!!

AC

Chart courtesy of stockcharts

Chart courtesy of stockcharts Chart courtesy of stockcharts

Chart courtesy of stockcharts Chart courtesy of stockcharts

Chart courtesy of stockcharts

Olá António!

Parabéns pelo teu blog. Está muito bem elaborado e é muito orientador, tenho conhecimento que se esta a expandir-se tanto para Oriente como para o Ocidente, isto é desde Singapura passando pelo Brasil, aliás, neste país está fazendo muito sucesso.

Parabéns por este serviço publico.

Posted by VF |

9:03 PM

VF |

9:03 PM