Chart courtesy of

stockcharts.comOil prices rose Thursday -- and again on Friday -- as refineries along the Gulf Coast encountered some minor obstacles in the aftermath of an oil spill that disrupted ship traffic in a Louisiana waterway. Oil prices had climbed Wednesday after government data showed a smaller-than-expected build in domestic gasoline inventories.

Crude Oil has a strong support area in the $68 mark.

Chart courtesy of

stockcharts.comAnother close below the 11.000 points, Dow Jones industrial fell 30.02, or 0.27 percent, to 10,989.09. The Standard & Poor's 500 index lost 1.10, or 0.09 percent, to 1,244.50, while the Nasdaq composite index dropped 1.51, or 0.07 percent, to 2,121.47.

The market posted a modest loss for the week.

Macro economic news on Friday : New orders for U.S.-made durable goods unexpectedly fell 0.3 percent in May as aircraft orders dived, according to a government report released on Friday that nonetheless showed healthy business spending.

Next week will be the FED meeting and the investors of futures are with an absolute certainty in that the FED will go to increase the taxes of interest in 0.25%, already for the week that comes to the 5.25%. A certainty of 85% of hypotheses in favor of an increase of the taxes of interest in August exists, being that it has two weeks behind was of 67%.

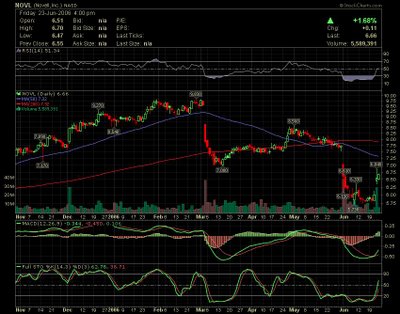

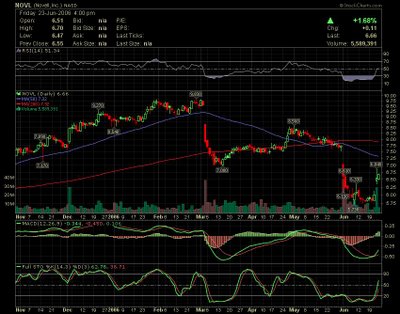

Chart courtesy of

stockcharts.comNovell Shares had a sharp increase on Thursday after the comapany ousted its chief executive and chief finanacial officer. "The board conclued that a management change would be the best way to accelerate the execution of our growth strategy and build value for shareholders", Novell said. Despiste this big up movement in the shares, I'm still cautions in the stock due the latest earning reports.

Support : $6.34 Resistance : $7

Chart courtesy of

stockcharts.comNokia and Siemens have announce on Monday the market that agreed to merge their wireless network businesses. The joint venture, which will be called Nokia Siemens Networks, and will create a telecom-equipment powerhouse generating revenue of about $20 Bilion a year.

Shares of Nokia are still trading in downtrend since May, and on Friday closed below the important support of $19.50, so perhaps in the short term we'll test the EMA200 now at $18,70, the indicators MACD+RSI are Bearish.

First Supports : $19,30 and $18,72 Resistance : $19,96

Chart courtesy of

stockcharts.comShares of Phoenix Tecnologies had a Big fall on Thursday after the company slashed its third-quarter revenue guidance. Now the company anticipates a revenue of $10 million to $12 million for the period ending on June 30 , well below its previous guidance of $24.5 million to $26.5 million. The company attributed this weak outlook to Microsoft's delayed launch of Vista. According to this chart above, shares of PTEC are is a very Oversold conditions, so a rebound is the stock can appear soon due the last candle "Inverted Hammer".

That'a All. Have a great weekend and an excellent business week !!!

AC

Chart courtesy of stockcharts.com

Chart courtesy of stockcharts.com Chart courtesy of stockcharts.com

Chart courtesy of stockcharts.com Chart courtesy of stockcharts.com

Chart courtesy of stockcharts.com Chart courtesy of stockcharts.com

Chart courtesy of stockcharts.com Chart courtesy of stockcharts.com

Chart courtesy of stockcharts.com

Só pra dizer que linkei no meu blog

Keep up the good work ;)

Posted by Anonymous |

12:08 PM

Anonymous |

12:08 PM