Google fell sharply in after-Hours

Shares of Google plunging in after hours after reported there earnings.

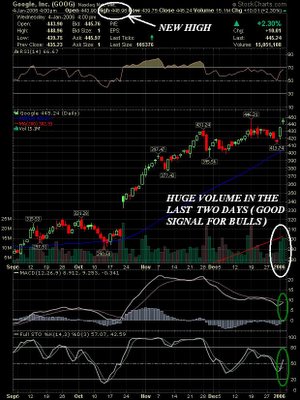

Google said it earned net income of $372 million, or $1.22 a share, up from $204.1 million, or 71 cents, a year earlier. Sales rose 86% to $1.92 billion. Excluding payments Google made to partners who send it Internet traffic, net revenue rose $1.29 billion, and the sales rose nearly 86% to $1.92 billion. Excluding the cost of stock option expenses and other charges, Google said it earned $469 million, or $1.54 a share, less than the $1.76 a share expected by Wall Street analysts. According to chart above we have many supports, but its dificult to predict which will be the biggest support, e.g 400 , 380 , 340 ..........because in after hours we are seeing a Sell Off.

At this moment shares of Google fell more than 16% in after hours to 360.

Today the Federal Open Market Committee increased its target for overnight interest rates by a quarter percentage point to 4.50% Tuesday. This is the 14th straight meeting with a quarter-point rate hike. The increase in the federal funds rate was expected by traders and economists on Wall Street. The vote was unanimous.

That's All. Have a great evening !!

AC