( click to enlarge )

King Digital Entertainment PLC (NYSE:KING) is one of my favorite stocks in the gaming sector. In a research note published in the mid of this month, JPMorgan reiterated an overweight rating and set a $20 price target on shares, citing that the company will experience a significant growth this year with a strong outlook on the Candy franchise and potential game launches. Additionally, the analyst Doug Anmuth raised the 2015 EPS estimate from $1.99 to $2.03. From a technical standpoint, I continue to see a potential Inverted Head and Shoulders pattern on daily. The stock closed above the $16 level today on high volume and is registering a strong Bullish signal on MACD. Let’s see whether the price can gather enough momentum to break through the neckline at $16.52. If the Bulls are able to push through this level, there will be another rally towards $17. The target of this possible inverted head and shoulder pattern is around $21.

( click to enlarge )

Rosetta Genomics Ltd. (NASDAQ:ROSG) had a nice surge a few weeks ago and has been in a correction mode. The stock is displaying upside momentum again and is poised to move higher from these levels. Nearest resistance for the stock is at $3.25 (200EMA). If this level is crossed and the stock is able to sustain above this level, then it might go to $3.75. Short-term technical indicators are improving and MACD is about to trigger a buy signal while RSI is neutral at 49. Keep an eye on ROSG tomorrow.

( click to enlarge )

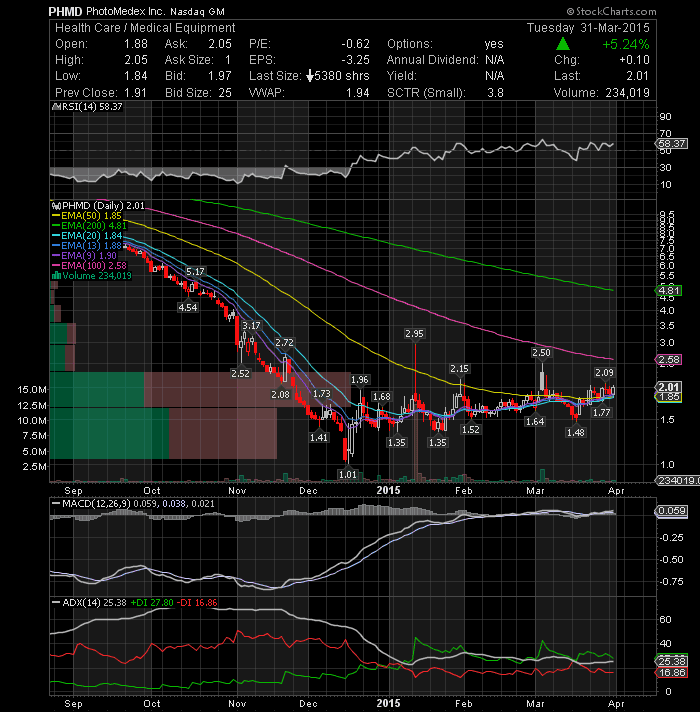

Shares of PhotoMedex Inc (NASDAQ:PHMD) soar today on good news. The US Federal Court dismisses suit against the company. The stock closed again above the $2 level on decent volume, a buy signal and an indication that the price may have finally reached its bottom. Next resistance level is $2.58 (100-day EMA). I will keep on eye on this stock tomorrow.

( click to enlarge )

Genetic Technologies Limited (NASDAQ:GENE) Good pattern and accumulation here, but I need to see further upside confirmation before adding a new long position.

( click to enlarge )

Second Sight Medical Products Inc (NASDAQ:EYES) is another stock I am watching closely. It can pop big time on any positive news. The technical daily chart is showing a possible falling wedge pattern. In addition, %K line has just crossed on top over %D line showing a buy signal as ROC is at oversold level. MACD Histogram is also showing positive divergences. This is a bullish pattern that requires confirmation with an upside breakout.

( click to enlarge )

Ambarella Inc (NASDAQ:AMBA) made a new 52-week high today, hitting $77.39, before closing the day at $75.71. I will watch the stock price tomorrow and buy above Tuesday’s high.

( click to enlarge )

Lumber Liquidators Holdings Inc (NYSE:LL) is recovering quickly from its recent bottom with MACD moving upwards. The stock looks like it wants to breakout of this small range, but has not been able to gain the needed momentum. You should keep this stock on your screen radar.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Labels: AMBA, EYES, GENE, KING, LL, PHMD, ROSG