( click to enlarge )

Editas Medicine Inc (NASDAQ:EDIT) has been trading heavy volumes recently and continue to impress with another show of strength. Could move toward 17.50 area if it breaks and closes above the declining 50-day EMA. Technicals look Bullish to me. Momentum picking up with MACD climbing and RSI rising. Watch for continuation.

( click to enlarge )

Digital Ally, Inc.(NASDAQ:DGLY) I alerted my followers on twitter this morning at 5.80 after read the news. The company announced the receipt of notable orders from the Santa Fe, New Mexico Police Department for its FirstVu HD body-worn camera, DVM-800 in-car digital audio/video system, DVM-440Motorcycle system and patented VuLink automatic activation system. DGLY had a nice breakout today with a pop of 70 cents to 6.40 or 12% on 253K shares, the biggest volume in a couple weeks. The 6.30 resistance was taken out with a thrust and could lead to more upside.

( click to enlarge )

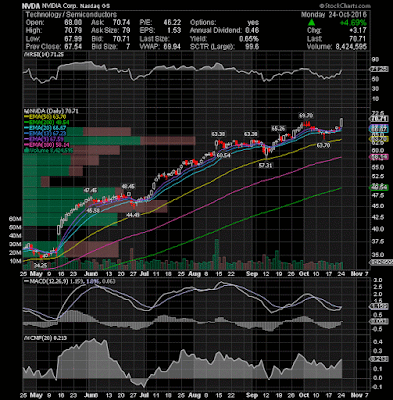

NVIDIA Corporation (NASDAQ:NVDA) made a new 52-week high today closing at $70.71 on solid volume. The stock hit a high of 70.79, which is now resistance for Tuesday’s continuation move. If the stock can break through resistance, we should see another upside move.

( click to enlarge )

Oclaro, Inc. (NASDAQ:OCLR) On my watch list. $8.33 (EMA20) is pretty much the pivot here. If the stock closes above this key level, momentum traders are likely to send the stock up to $9.30 again.

( click to enlarge )

Sirius XM Holdings Inc. (NASDAQ:SIRI) is quietly gaining momentum. The major resistance level is not that far away and would represent a point of serious resistance. Fresh buying may be considered on a move past $4.22, using the rising EMA200 as stop-loss. The MACD had just cut above its signal line. On watch.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Labels: DGLY, EDIT, NVDA, OCLR, SIRI