( click to enlarge )

Slack Technologies (NYSE:WORK) is nearing a key resistance level that has contained prices on two occasions in the last sessions. Considering the recent strong momentum, I think the stock looks set to break higher and rise above its rising 50-day EMA. The immediate support level is located at 25.06 followed by 24.41. Keep this stock in your radar list.

( click to enlarge )

Shares of Synthesis Energy Systems, Inc. (NASDAQ:SES) soared 191% to $5.25 per share after the company announced it purchased Australian Future Energy in all-stock deal worth $36M. Although the stock has been in weak market for the past few months, yesterday rally shows the stock is back on uptrend on rising MACD and RSI. With MACD now barely hit above 0, we probably will see more positive action coming from the stock. Long setup on watch. Any close above the green line (EMA200) will confirm the trend change.

( click to enlarge )

Based on the daily chart above, I feel Arcadia Biosciences Inc (NASDAQ:RKDA) stock is well over due for a counter trend rally, and I think it could see $6.5 or better if investor interest comes back into this stock. This stock was trading over $10 a share less than two months ago. From a technical standpoint, MACD is curling up and the RSI is in the oversold region, showing some signs of reversal. Thus, a strong reversal over the coming days is expected. This is the perfect stock to expect a SES type-move.

( click to enlarge )

I think it's time to reconsider adding Onconova Therapeutics Inc (NASDAQ:ONTX) to your portfolio for a potential big bounce. The company is now well-funded for the coming months with the recent offering at $1.60 and after the HanX Biopharmaceuticals deal. I started accumulating the stock. From a technical standpoint, MACD has generated a bullish alert and the RSI is in the extremely oversold region, a volatility squeeze seems eminent. Technicals are showing positive divergences supported by rising MACD and Slow Sto on the daily charts. Plus, there is a gap to fill over1.3

( click to enlarge )

VISTA OIL & GAS/S ADR (NYSE:VIST) Friday's breakout on strong volume is highly noteworthy and this stock should be added to your watch-list for consideration when the uptrend resumes.

( click to enlarge )

Tetraphase Pharmaceuticals Inc (NASDAQ:TTPH) is looking quite good here for higher prices. I'm watching closely this tiny float stock for a breakout above 3.95, as the stock has been basing nicely.

( click to enlarge )

The share price of Whiting Petroleum Corp (NYSE:WLL) is showing signs of a potential reversal. Clear break above 7.73 (EMA20) could trigger further bullish recovery testing the 8.56 area.

( click to enlarge )

Scworx Corp (NASDAQ:WORX) There are some signs of a possible bounce at this point due to the oversold conditions and some positive divergences on daily MACD, which often leads to short covering. A reversal may be on the way. Im long. This stock has a history of massive rallies at major supports.

( click to enlarge )

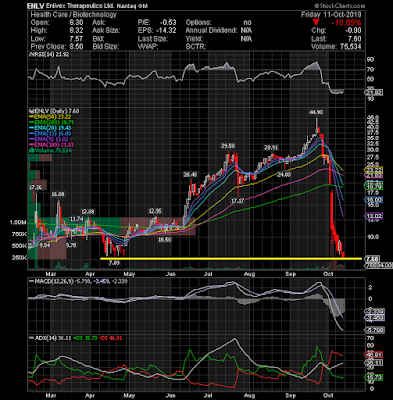

Enlivex Therapeutics Ltd (NASDAQ:ENLV) has been in a tremendous tailspin the last three weeks. It has seen a bevy of selling bring the stock to fresh new lows for the year and i cant find "news" that could justify the scale of decline. I took a long position on stock last week, because i believe we could see a sharp rally out of these extreme oversold conditions.

( click to enlarge )

AMD (NASDAQ:AMD) Another stock with a nice look. Resistance Breakout. Go long on the break of Friday’s high at 30.20. MACD crossover and RSI could help it get into 32's again.

( click to enlarge )

I have LYFT Inc (NASDAQ:LYFT) on my watchlist for next week. It might attempt to breakout above $40.31 level again and if it succeed we should expect a strong move to the upside.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Labels: AMD, ENLV, LYFT, ONTX, RKDA, SES, TTPH, VIST, WLL, WORK, WORX