( click to enlarge )

Globalstar, Inc. (NYSEMKT:GSAT) which has been in a nice bullish trend, jumped 38 cents or 19.90% Friday and finished at the highest close in more than eleven months. The move confirmed a breakout from a large sideways price consolidation pattern, in which the stock has been consolidating for the last five months. Next week, I expect continuation of the current uptrend toward the next resistance area around the $3 area. Long setup.

( click to enlarge )

The Merrimack Pharmaceuticals Inc (NASDAQ:MACK) continued to show strength with another gain. Friday's rally put shares above the declining EMA100 at the $3.57 level, which is a bullish sign. The technical daily chart looks very bullish now with a short-term target of $4.25

( click to enlarge )

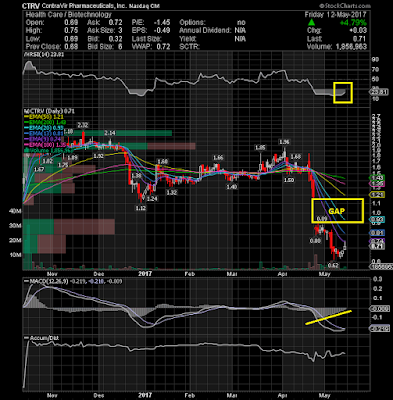

ContraVir Pharmaceuticals Inc (NASDAQ:CTRV) had a nice bounce last week but we need to get another up session with decent volume to solidify this as a bottom. Momentum indicators are in favor of an upward price movement. Watch for trend continuation toward 80c zone short-term.

( click to enlarge )

Keep a close eye on Monster Digital Inc (NASDAQ:MSDI) next week. I think the stock may have bottomed and could be poised for a bounce back. Note the positive divergences on the MACD and the CMF. If the stock price breaks the 73c level in the next sessions, momentum traders are likely to send the stock up to $1. Keep it on your watch list going forward.

( click to enlarge )

Proteostasis Therapeutics Inc (NASDAQ:PTI) I still think in the short-term the stock will bounce nicely off this bottom. Looking to see if stock can get over $4.75 for nice bounce into 6's. Many institutions are loading up (JP Morgan, BlackRock Inc, etc..), so i think current levels could prompt a strong bounce to the upside. The stock has a story of Big bounces.

( click to enlarge )

Quotient Ltd (NASDAQ:QTNT) Thin name with a good looking chart. Should breakout hard to upside when it crosses over $7.54

( click to enlarge )

VBI Vaccines, Inc. (NASDAQ:VBIV) could be in the early stages of a technical breakout. A break through Friday's high on volume could lead this stock to 5.23-5.5 short-term.

( click to enlarge )

Superconductor Technologies, Inc. (NASDAQ:SCON) is setting up for possible breakout. Go long on the break and close above the declining 200-day EMA. From a technical standpoint, momentum indicators are bullish but giving mixed signals, which is usually during sideways consolidations.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Labels: CTRV, GSAT, MACK, MSDI, PTI, QTNT, SCON, VBIV