( click to enlarge )

Ceres Inc (NASDAQ:CERE) has been trading with a consistent rise of interest this month and the CMF has been getting stronger by the day. The CMF indicator shows rising buying pressure during the last 3 weeks. CERE's 71c level looks to be the new solid base setup and looks poised to breakout soon. I'm looking at a potential 30 to 40% gainer short term. The company has a strong cash position (63c ps ). Keep it on your radar screen because the technical chart looks very bullish to me and looks in the verge of a breakout.

( click to enlarge )

BlackBerry Ltd (NASDAQ:BBRY) had a strong bullish momentum on Thursday after some takeover rumors that Samsung could be interested in acquiring BlackBerry. The Financial Times also reported that company is looking to partnerships to compete with Apple and IBM venture. Early this morning in an interview with Romit Guha of "Economic Times" the CEO John Chen said that the new device Z3 has been extremely well received in India & Indonesia, and he continues to see strong demand for the device. In addition, Chen said that the BlackBerry Enterprise Service 10 (BES10) has seen more than 1,000 installations in India. From a technical stanpoint, we saw a strong bounce yesterday with a 5.60 percent rally accompanied by strong volume, suggesting that the bounce will continue today. The bias was downward, but with yesterday's rally that has shifted to neutral. The higher short interest ( 19% or 92M ) could also provide a near-term catalyst, if the stock begins to rise. We could see further upside over Thursday’s highs. A close above $10.5 would have positive implications and could push the stock to the 11-11.5 range.

( click to enlarge )

Caterpillar Inc. (NYSE:CAT) broke out to the downside of a rising wedge chart pattern on the daily. I expect more selling pressure and a move down to test the recent $100 lows would likely be next.

( click to enlarge )

Corning Incorporated (NYSE:GLW) is coming up to a possible breakout. Watching for it to break above $22.37

( click to enlarge )

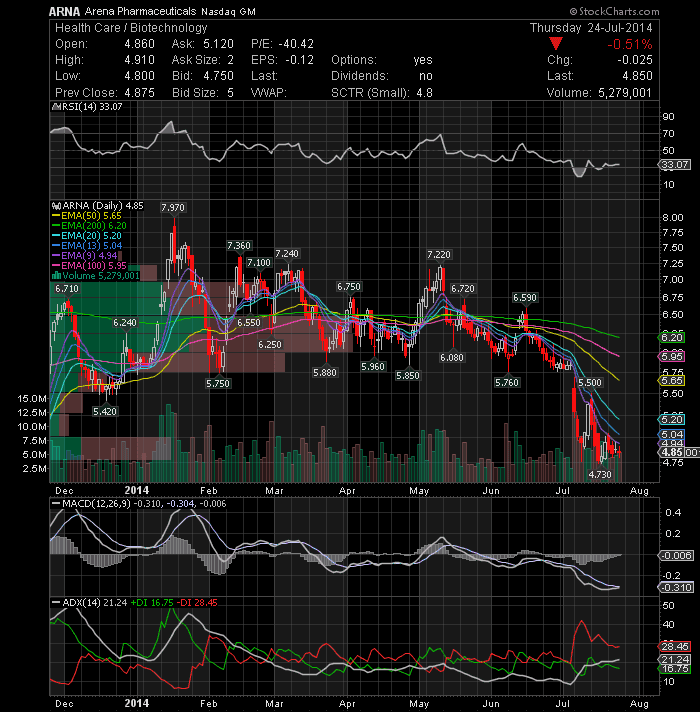

Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) May have put in a short term bottom. Watch EMA50 at 4.94 breakout and possible get above 5. Stop 4.72. Daily MACD showing signs of a stabilization.

( click to enlarge )

Apple Inc. (NASDAQ:AAPL) could be flagging here, watch for above average volume. I'm stalking this stock to see if it clears 97.88

( click to enlarge )

Netflix, Inc. (NASDAQ:NFLX) closed slightly below the 50-day EMA on Thursday for the first time since May. My outlook remains bearish in nearest term testing $400 as a part of the bearish scenario since formed the false breakout around 475.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Labels: AAPL, ARNA, BBRY, CAT, CERE, GLW, NFLX