( click to enlarge )

GameStop (NASDAQ:GME) The stock gained more than 150% last week on strong volume accumulation and it has been in a bullish consolidation over the last two trading days after a big move on Wednesday that took it from the mid-40s to mid-180s. A successful break of this bull flag pattern on H4 could set the stage for stock to test the price region around 200. Technical indicators are looking bullish to me.

( click to enlarge )

In order to stage a bullish trend reversal, BlackBerry (NYSE:BB) needs to break and close above the 12. Short-term daily technical indicators are improving and the MACD on the H4 chart recently produced a new buy signal last week. If the stock can break Friday’s high of $10.82, we should see a strong follow through move. BB will move very quickly, so keep a very close eye on the stock next week. Stock has a strong support around the 9.69 area.

( click to enlarge )

LAIX Inc (NASDAQ:LAIX) I bought back my shares on Friday. From a technical standpoint, the stock closed the big gap made on February 5 as it gave up much of its gains from the past three weeks. Technical indicators are showing positive divergences. I'm betting on a reversal and a possible rise over $3.08 in the coming days.

( click to enlarge )

Janone Inc (NASDAQ:JAN) I have been accumulating this stock. The company announced last week that it has entered into a definitive agreement to sell its legacy recycling subsidiary, ARCA Recycling, to Virland Johnson, JanOne’s Chief Financial Officer, for an aggregate purchase price of approximately $25 million. The current market cap of the company is just $23M. This stock remains, in my view, undervalued, and based upon recent actions by the company, I think the price per share should head higher. I still think this is a $15 - $20 stock down the road. The way to make money in these markets is to find the undervalued stock before the market does.

( click to enlarge )

Aikido Pharma Inc (NASDAQ:AIKI) was over $2.55 on February 16 and closed Friday at $1.19. The stock is back at the bottom area and could provide another great swing trade. I bought shares last week. A break and close above the 1.25 level next week could move the stock significantly higher.

( click to enlarge )

Ocugen Inc (NASDAQ:OCGN) Missed this one on Friday because I was too busy watching WSB stocks. But this chart looks pretty good. I think current levels offer a great chance to play a rebound in shares. Long positions can be considered with a stop loss of 9.50 on a daily closing basis. Initial targets are 13.50 and 17

( click to enlarge )

I like this stock (NASDAQ:NVOS) for a nice rebound from Friday's $5.21 close. The stock has been finding support at its 100EMA on the 30m chart. We could be looking at the start of a sharp rally for this stock. It's down from $14.98 to $5 with not much of a bounce in between. I think a 25-40% gain or more lies ahead.

( click to enlarge )

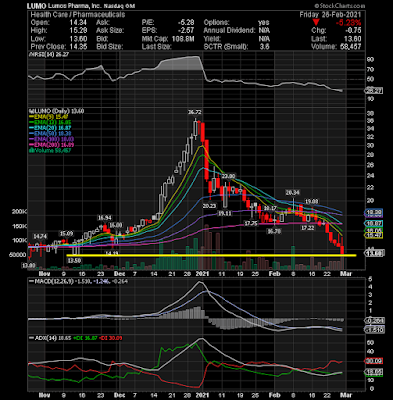

Lumos Pharma Inc (NASDAQ:LUMO) another small name that could see a big rally from current levels due to very oversold conditions. Plus, potential double bottom.

( click to enlarge )

Fisker Inc. (NASDAQ:FSR) The stock saw continued buying pressure on Friday. With this breakout move and future potential this stock should remain one to watch going forward. Buyable on any pullback to pivot.

( click to enlarge )

Townsquare Media Inc (NASDAQ:TSQ) is flagging nicely on the daily chart. Watch Monday's action for a possible breakout over $11.25

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Labels: AIKI, BB, FSR, GME, JAN, LAIX, LUMO, NVOS, OCGN, TSQ