( click to enlarge )

I'm keeping an eye on Image Sensing Systems, Inc. (NASDAQ:ISNS) for a breakout above its 50-day EMA located now at 3.27. A break of this flag/pennant pattern could move the stock towards the $4 level. The stock looks pretty good holding above its 13 and 20 day exp moving averages. The 9 day EMA also just crossed above the 13 day EMA which is another positive bullish signal I use. A successful breakout over 3.27 would have an estimated target of $4. Don`t miss the run higher. This is a hot stock to watch.

( click to enlarge )

Ulta Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA) could breakout again at any moment ! Next buy point when clears 121.43 on heavy volume.

( click to enlarge )

AMAG Pharmaceuticals, Inc.(NASDAQ:AMAG) Flagging here. Watching over 34.50 to see if any reaction.

( click to enlarge )

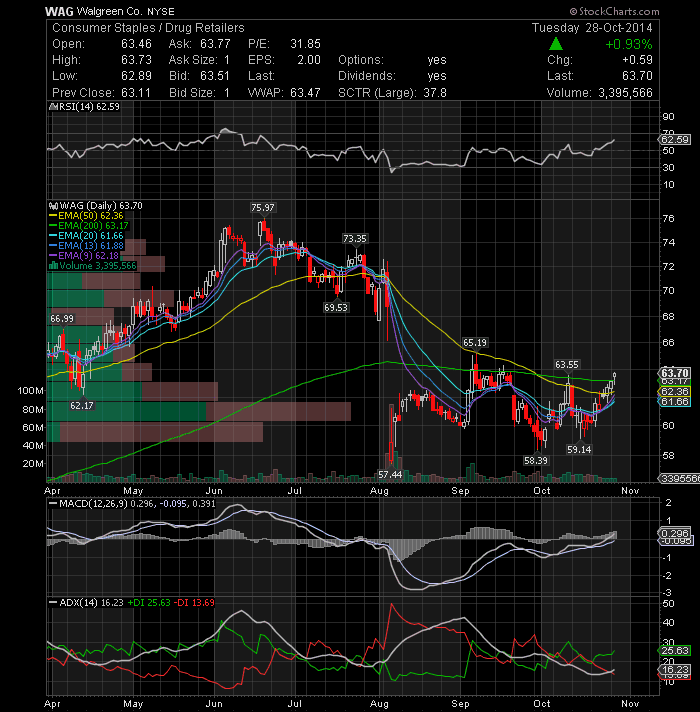

Walgreen Company (NYSE:WAG) has been in a strong upwards trend the past few days and looks ready to continue this move. The technical chart above suggests that stock might find now resistance at $65.19. Only a close above this level would suggest further upside.

( click to enlarge )

Rite Aid Corporation (NYSE:RAD) Bullish engulfing bar today, more upside to come IMHO. Next buy when clears the $5.17 level on heavy volume. We start to see now some signals of rebound as the technical chart above shows positive momentum is back. Stop 4.74

( click to enlarge )

Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA) has the perfect set up to make a nice run here. The break out point would be at $6. From a technical standpoint, the stock is trading above 20/50-day and 100-day EMAs with all short-term moving averages pointing upwards. In addition, the daily MACD indicator is back above signal line also indicating a buy. Stay tuned.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Labels: AMAG, ARIA, ISNS, RAD, ULTA, WAG